The year 2024 was a groundbreaking year in the evolution of cryptocurrency Exchange Traded Products (ETPs) for a number of reasons. It started with the historic approval of U.S. spot Bitcoin Exchange Traded Funds (ETFs) in January 2024 by the Securities and Exchange Commission (SEC) and ended in December 2024 with the full-applicability of the Markets in Crypto-Assets Regulations (MiCAR) in Europe. These developments represent a global trend towards greater acceptance and accessibility of crypto assets resulting in an unprecedented growth in the global crypto ETP landscape.

By November 2024, assets under management (AUM) for crypto ETPs surged to more than $130 billion, representing an impressive 950% increase year-over-year (this was partially driven by BlackRock’s iShares Bitcoin Trust ETF (IBIT), which became the fastest ETF to reach $10 billion in AUM, achieving this milestone in just under 2 months). This year was off to a good start with another $585 million of inflows which were registered in the first few days of 2025. Trading volumes also saw significant growth, reaching $87.5 billion by November 2024, an 817% increase from the previous year. This surge in activity reflects the accelerated integration of digital assets with the traditional financial system, enhancing market accessibility through regulated investment vehicles.

As we reflect on the exceptional developments in 2024, we are joined by Romain Bensoussan, Head of Sales at Deutsche Digital Assets (DDA), who shares his insights into this pivotal year and his vision for the future of crypto ETPs.

2024 witnessed unprecedented growth in crypto ETPs through regulatory breakthroughs, which made the integration of digital assets with traditional assets easier, improving accessibility for individual investors and institutional adoption. Where and how have crypto ETPs fitted in the global Portfolio Allocation of investors?

Romain: We are witnessing an increasing adoption and a growing allocation to crypto investment solutions by both individuals and institutional investors in Europe.

Crypto ETPs have, indeed, played a significant role in this growing adoption by providing an enhanced accessibility to this new asset class, with products listed on the most liquid European stock exchanges such as Deutsche Boerse Xetra, Euronext Paris & Amsterdam, or SIX in Switzerland.

For private investors, Crypto ETPs provide a regulated and easily accessible way to get exposure to digital assets without the complexities and risks associated with direct custody, private key management, or exchange counterparty risk. For example, Deutsche Digital Assets’ ETPs are always 100% physically collateralized by the respective underlying asset and stored in “cold storage” at regulated custodians. We usually discuss an allocation between 1-5% to Cryptoassets for private investors, as part of an alternative asset strategy, targeting long-term appreciation of the capital while managing volatility via a broader portfolio diversification. Individual investors tend to allocate most of their crypto investments to the top 10 crypto currencies by market capitalization, focusing on large caps like Bitcoin & Ethereum, and adding altcoins as a source of further diversification.

Institutional investors, on the other hand, have been slowly integrating Crypto ETPs as part of their alternative investment strategies. The regulated and secure framework of Exchange-Traded-Products made the integration of digital assets within a traditional portfolio easier. The approval of spot Bitcoin ETFs in the U.S, and similar regulatory progress in Europe (e.g. MICA regulation) have also facilitated greater institutional adoption by acting as a stamp of approval for the asset class.

In terms of allocation, institutional investors usually incorporate Crypto ETPs as part of a multi-asset strategy, balancing them with traditional asset classes such as equities, bonds and commodities to optimize risk-adjusted returns. They are also more likely to look at sophisticated alpha or smart-beta strategies.

As a European digital asset manager, you are directly impacted by regulatory developments in Europe. MICA and its Regulations were a significant development. How has this affected the legitimacy and stability of the crypto investments offering?

Romain: The recent regulatory developments in Europe have, indeed, been very helpful to the different crypto asset managers in Europe. The MICA regulation brought legitimacy and stability to this new asset class, leading to a greater adoption among institutional investors.

With a harmonized framework, MICA aims to establish legal clarity for both issuers of investment products, and institutional investors.

On the issuer side, asset managers will need to comply with strict compliance standards - comparable to those applied to traditional asset classes – to ensure transparency and robust product structure, ultimately mitigating concerns around operational risks, fraud and market manipulation. We are well positioned to benefit from these regulatory developments, as we’ve been respecting the most stringent regulatory requirements for years, working exclusively with regulated counterparties and – through one of our subsidiaries, DDA Advisory GmbH – being a fully regulated BaFin portfolio manager.

On the allocator side, this regulatory clarity will reassure both private and institutional investors, which will facilitate the integration with their global allocation among traditional assets.

With the MICA implementation, Europe will be more than ever positioned as a leader in regulated digital asset investment solutions, making it easier for asset managers like DDA to expand and offer institutional grade products to the market.

Crypto ETPs are based on an underlying asset class which is known for its high volatility and 24/7 trading. How do crypto ETPs address some of these challenges that are specific to the asset class? And what are the key considerations when assessing crypto ETPs?

Romain: Although the volatility of digital assets tends to decrease over time with the market maturing (e.g. Bitcoin’s volatility currently stands at 2-3x the volatility of traditional asset classes, and is sometimes less volatile than commodities, or tech equities), it is still showing strong volatility.

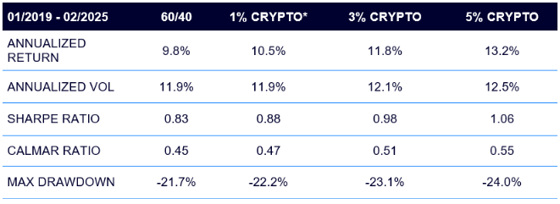

Private and institutional investors should always keep in mind that addressing the volatility issue of Bitcoin & Digital Assets can be done simply and easily by weighing this asset class in a correct fashion when constructing their portfolios – e.g. assigning an appropriate weight to crypto assets in your portfolio, will allow you to benefit from the performance of the asset class. Astonishingly, a 1-5% allocation to such a high-volatility asset does not harm the overall portfolio volatility. As shown in the illustrative table below, a 1-5% allocation to the top 10 Cryptoassets in a classic 60/40 portfolio improves the annualized return and keeps the portfolio volatility at similar levels, hence, delivering a better Sharpe ratio.

Source: DDA, as of 28 Feb 2025

Overall, when deciding to allocate in a Crypto ETP, the key considerations should be very similar to investing in a traditional equity ETF: a regulated custody structure and a strict segregation of assets, a strong liquidity to ensure a good execution and limited slippage, the underlying index should be replicated without significant tracking error, and the T.E.R should be competitive.

Earlier this year, DDA expanded into France. What were the main considerations done by your team in selecting France as your next expansion? Do you plan to expand in other countries?

Romain: The expansion of DDA in France was quite a natural and logical choice.

France currently sits as one of the most significant financial hubs in Europe, with more than 600 asset managers (500 located in Paris) and a growing market for ETF/ETP investments.

Moreover, DDA will benefit from a well-established network of financial partners and allocators in Paris, as the team there has been working for the biggest local traditional asset managers and crypto asset managers.

From a regulatory perspective, the AMF (French financial regulator) has always been very proactive regarding crypto & blockchain projects, with one of the most structured legal frameworks in Europe - the PSAN/CASP registrations have been active and structured for years, and we’re starting to see some agreements being delivered. French private banks and institutional allocators are slowly but surely starting to allocate to this new asset class, and this was one of the key considerations when deciding to expand here.

We are indeed, exploring further expansion in other countries, in line with a global European growth strategy. The short-term focus will be on countries showing growing interest in ETF/ETPs as we strongly believe that this product format will soon take over traditional investment funds.

Switzerland could be an option, as the country has a strong appetite for digital assets investment solutions. Over the long term, the UK could also be an option, although some strong barriers still exist. The FCA currently does not allow the distribution of crypto ETPs to retail investors, meaning all ETPs listed on the LSE are only available to professional investors.

With 2024 being a breakthrough year for crypto, now that we are four months into the new year, is 2025 continuing the pace of evolution? What are the future developments that you think will positively impact crypto ETPs and how will DDA fit into this?

Romain: 2024 has been a game-changer for the crypto industry, starting in January 2024 with the approval of US Bitcoin spot ETFs, followed in April by the famous Bitcoin halving, and by the re-election of Donald Trump in November. Those consecutive events had a strong impact on the price of Bitcoin, pushing it to a new all-time high of 109k$ in January 2025.

Four months into the new year, 2025 has been quite binary in terms of digital assets developments.

On the one hand, from a pure price perspective, the beginning of 2025 has been quite disappointing. This is mainly due to global economic uncertainty (with the resurgence of US inflation, potentially stopping the current Fed rate-cut cycle), and to the tariffs war weighing heavily on risk assets such as equities and digital assets.

On the other hand, we do see some structural positive developments, such as the ongoing conversation about a US strategic reserve in crypto – although terms and details are still to be confirmed. This would mark a significant step into a global adoption of Bitcoin & Cryptoassets in the US, probably followed by similar initiatives all around the world.

On our side, we believe that 2024 has marked a change of paradigm for the crypto investment solutions market, and that 2025 could be one, if not the biggest, adoption wave for this asset class.

In June last year, we brought to the market the DDA Bitcoin Macro ETP, the first ever active European ETP dynamically allocating between Bitcoin & USDC based on Macro economic factors, which is a revolution in a market saturated with passive, single underlying ETPs.

We are better than ever positioned to benefit from the recent developments of the market, both from a regulatory perspective, and an innovation perspective where we intend to issue new unique products to the market in the course of 2025.

About DDA

Established in 2017, DDA is a German digital asset manager that serves as a trusted gateway for investors seeking exposure to crypto assets. DDA, through various subsidiaries, offers a menu of crypto investment products and solutions, ranging from passive to actively managed exposure, as well as financial product white-labeling services for asset managers. Additionally, the company offers investment advisory services for Family Offices, High Net Worth Individuals (HNWIs), and institutional investors. Through the DDA’s crypto ETPs, investors are able to participate efficiently in the price development of a single digital asset or basket of digital assets from their personal bank accounts or preferred brokerage accounts. All products are always 100% collateralized by the respective underlying(s), stored in “cold storage” at regulated custodians. DDA crypto ETPs are traded on the most liquid European stock exchanges just like shares or ETFs.

Important Notices

This article represents solely non-binding preliminary information which serves exclusively advertising purposes. It is not a prospectus in the sense of the Regulation (EU) 2017/1129 (Prospectus Regulation) and the German Securities Prospectus Act (Wertpapierprospektgesetz – WpPG).

Risk Considerations

The price of an investment in a DDA ETP may go up or down and the investor may not get back the amount invested.

The price performance of cryptocurrencies is highly volatile and unpredictable. Past performance is hence no guarantee of future performance.

You agree to do your own research and due diligence before making any investment decision with respect to securities or investment opportunities discussed herein.

The approval of the prospectus should not be construed as an endorsement of the securities offered or admitted to trading on a Regulated Market. These are not extensive risk considerations. Prospective investors should read the prospectus before making any investment decision to fully understand the potential risks and rewards of deciding to invest in the securities.

Trident Trust Disclaimer

The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of Trident Trust. The information provided in this article is for general informational purposes only and should not be construed as financial, legal, or tax advice. Trident Trust does not endorse, recommend, or make any representations about the accuracy, reliability, or completeness of the information contained in this article. Readers are encouraged to seek professional advice before making any financial decisions.